NORTHEASTERN UNIVERSITY OAKLAND

Our West Coast hub for experiential learning, research, and entrepreneurship

Discover the power of experience in the culturally diverse, vibrant Bay Area.

About our Oakland campus

Immersive learning. Collaborative problem solving. A spirit of innovation. Join a tight-knit community of like-driven classmates and colleagues drawn to the creative, entrepreneurial spirit that makes the Bay Area one of the world’s most dynamic and economically important regions. Find out how what you do and experience here will deepen the impact of your work everywhere.

Undergraduate Programs

Degrees with an edge

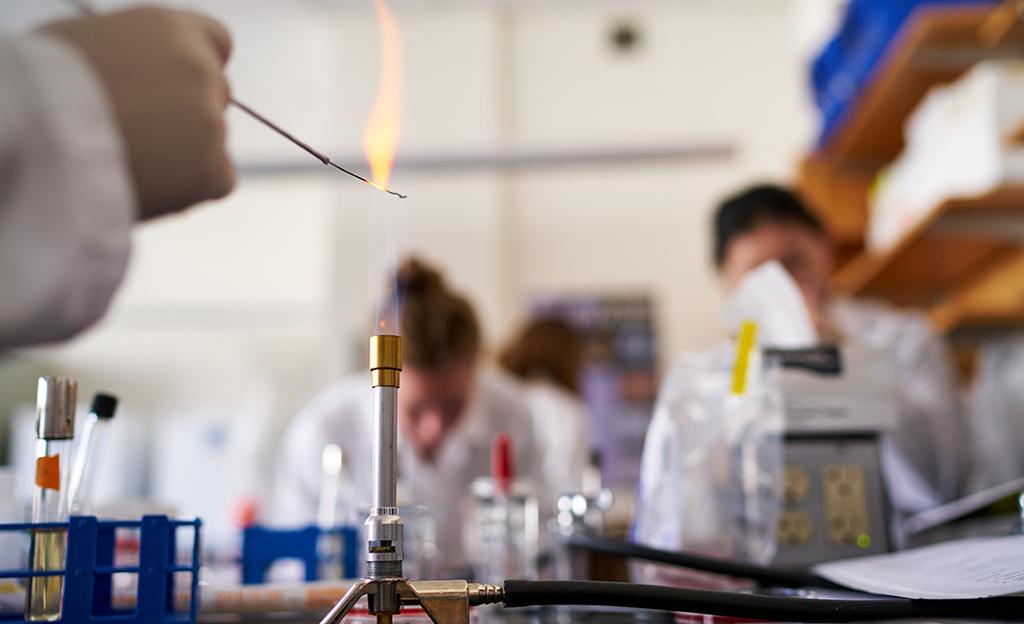

Explore your interests through degrees and interdisciplinary majors spanning business, healthcare, science, and technology. Whichever major you choose, your studies will be enriched by our Experiential Entrepreneurship programming and real-world learning opportunities throughout the Bay Area.

graduate Programs

Industry-aligned master’s programs

Choose from master’s degree programs that align with your goals and the fastest-growing fields. Through our Experiential Network (XN), you’ll build skills and experience that prepare you for your next professional step, supported by our extensive global network of alumni and partner organizations.

Innovative Solutions

Experience-driven research

Partner with us to solve challenges facing your organization and society through collaborations with our interdisciplinary faculty experts. Focusing on health, security, and sustainability—with expertise in aerospace engineering, cognitive and information sciences, and social impact and innovation—our research model leads to globally scalable solutions.

Equity and Social Justice

The Mills Institute

The Mills Institute at Northeastern focuses on advancing research and effective programs in education access, equity, social justice, and women’s leadership. Benefit from a one-of-a-kind opportunity to work on important equity and inclusion issues, with solutions that start in Oakland and extend to communities around the world.

A thriving network of opportunities

With locations in California’s Silicon Valley, Seattle, and Vancouver, British Columbia, you’ll have plenty of opportunity to earn real-world experience and collaborate on research here, and across our entire global network.

You’ll also have access to academic, research, and career development opportunities across geographic, sociopolitical, and cultural contexts as well as global resources to effect change.

17,380

Northeastern and Mills College alumni in the San Francisco Bay Area—300,000+ worldwide—ready to connect, support, and mentor

3,000+

co-op employer partners worldwide, with 250+ in the Bay Area, where you can gain professional experience

2,000+

startups with whom to connect throughout Oakland

1,400+

Bay Area co-op students hired by high-tech giants like Meta, PayPal, and Toast since 2018

1,250

Oakland-based nonprofits to work with on solving issues of social impact